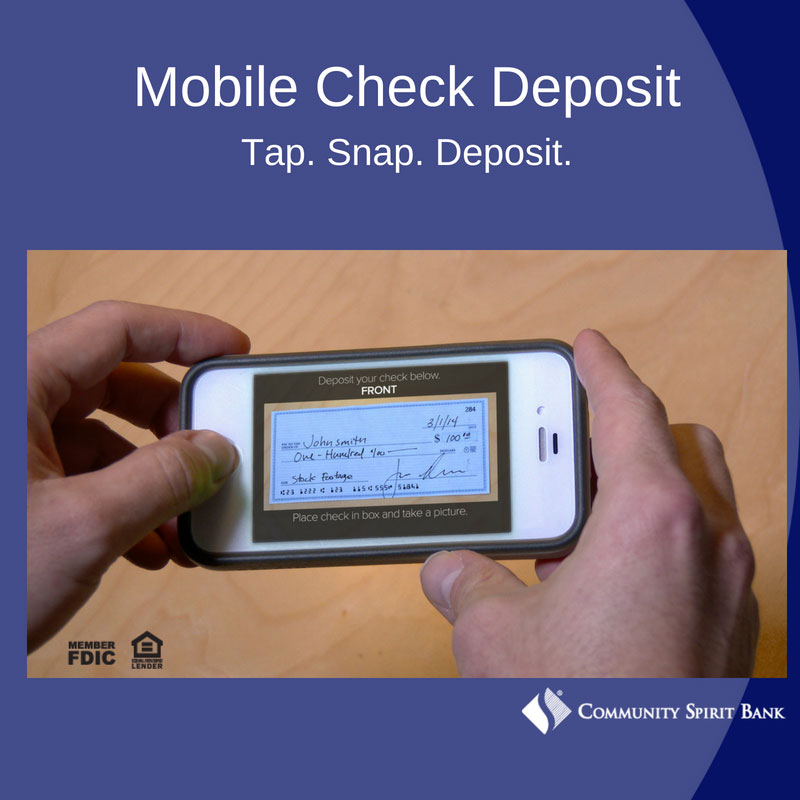

Mobile Check Deposit allows you to use your smart phone to take a picture of a check and deposit it into one of your accounts that are linked to your CSB Internet Banking.

There is no signing up! If you have the CSB Mobile App it will automatically be available to you starting 6/28/2018.

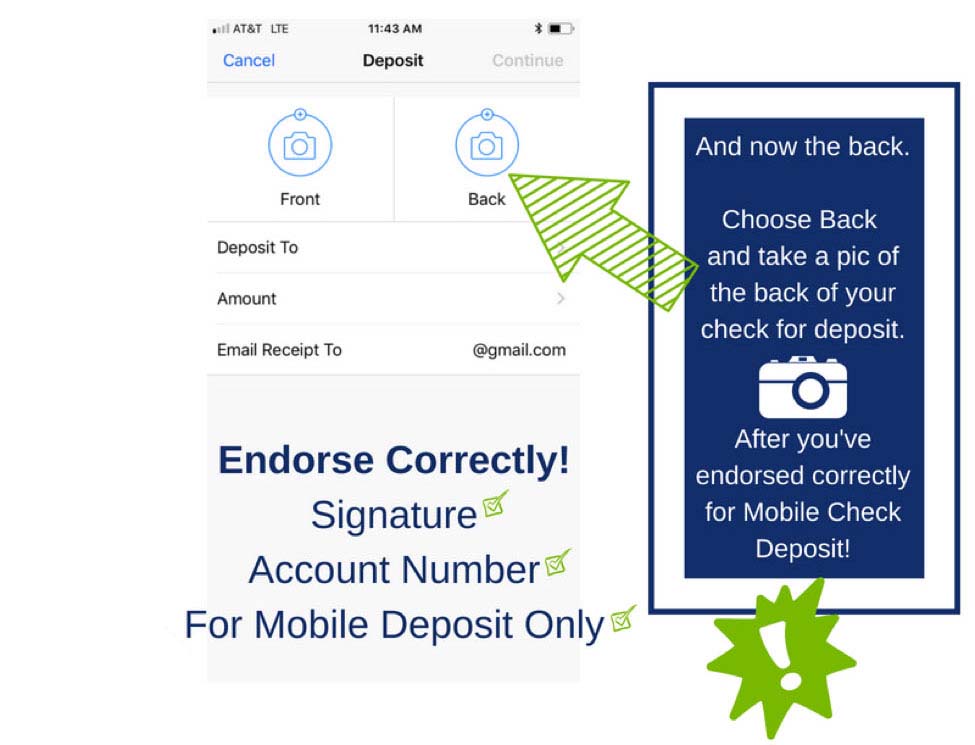

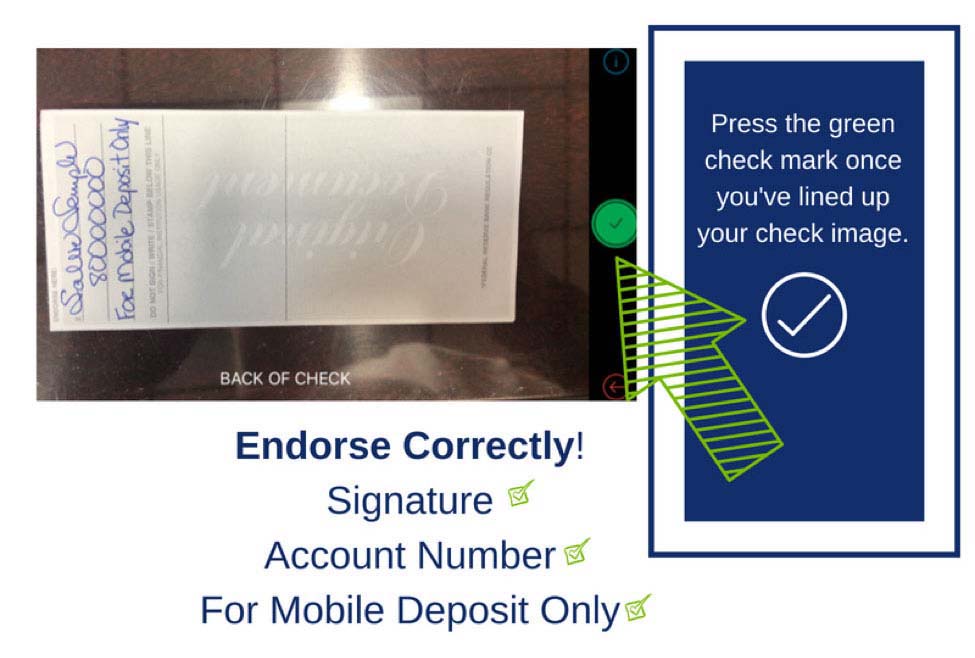

The endorsement is most important! For safety and security CSB requires ALL checks deposited with MCD to be endorsed on the back with the following:

- Customer signature

- For Mobile Deposit Only

- Customer account number

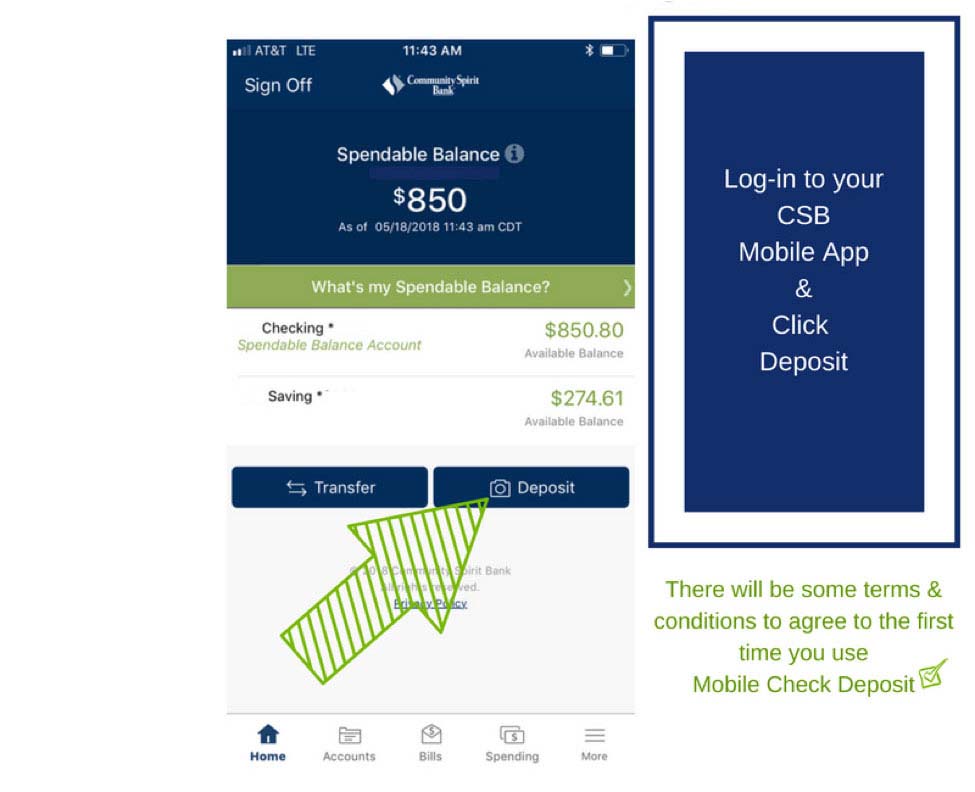

- Log in to your mobile app as you always have.

- Click the button with the camera that says Deposit.

- Follow the prompts.

- Sign/Endorse the back of the check exactly as required! This will help prevent your mobile deposit from being rejected.

- When you are prompted for the check amount, carefully enter the check amount to ensure it matches the amount written on the check.

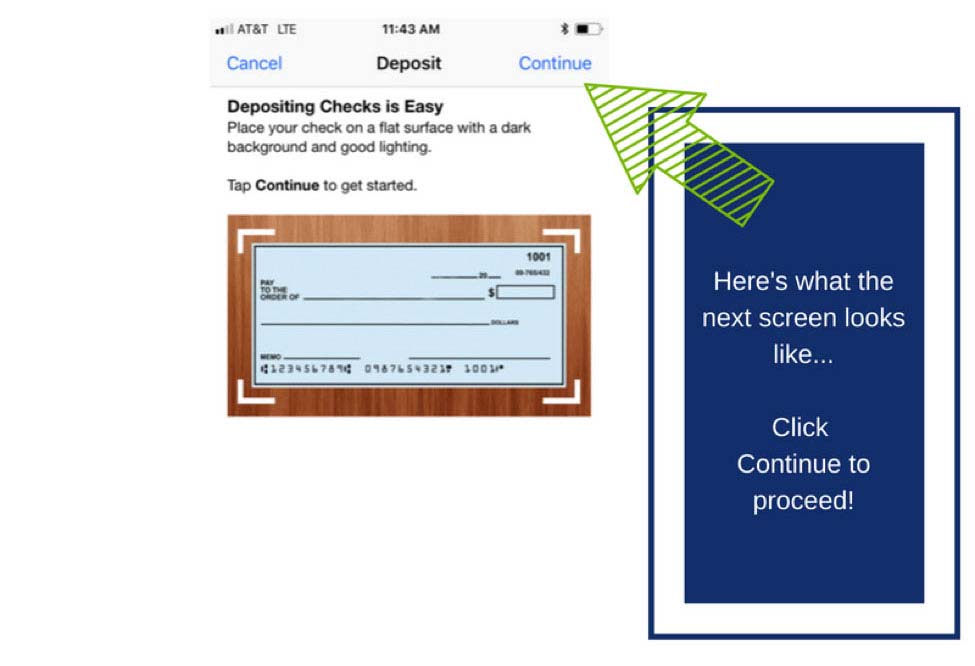

- In order to provide efficient processing of the check, flatten any folded or crumpled portions of the check before taking the photo.

- Place the check on a solid dark background before taking the photo of the check for ease in viewing.

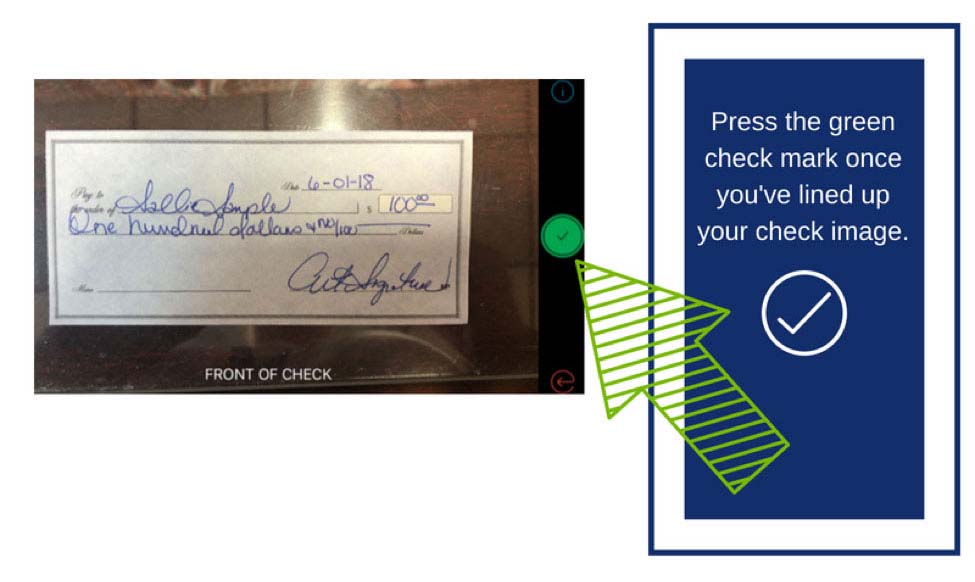

- Keep the check within the view finder on the camera screen when processing the photo of the check.

- Take the photo of the check in a well-lighted area.

- Keep your phone flat and steady above the check when taking your photo in order to have a clear image.

- Ensure the entire check image is visible and in focus before submitting the deposit.

- Verify that the check image is not blurry and MICR line (numbers on the bottom of the check) is readable. Make sure all four corners of the check are visible.

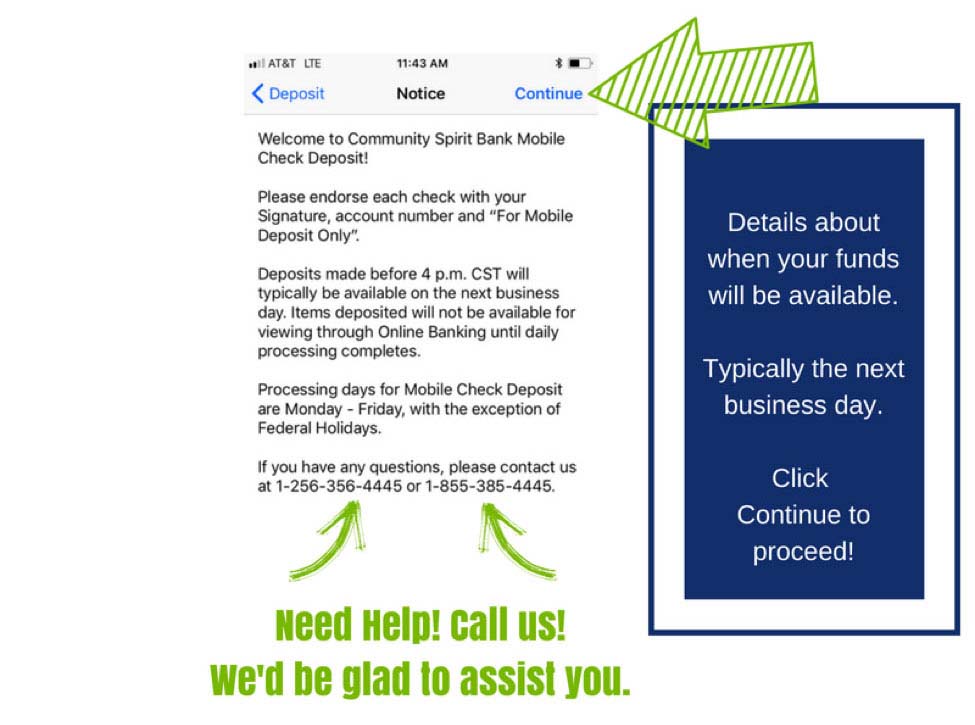

- You will receive a confirmation email when the mobile deposit has been received, a second email will be sent letting you know the item was approved or rejected.

- Community Spirit Bank checking or savings account

- Enrolled in CSB Online Banking

- Download CSB Mobile App

- Current iPhone, iPad or Android phone model

- Ability to use phone camera

- The CSB Mobile App installed (Available in the app store on your device)

- Standard $2,500.00 daily deposit per user

- Standard monthly maximum of $15,000.00 per calendar month

- Three Mobile Check Deposit items per day.

- Cut-off Hour. Current cut-off hour for Mobile Check Deposit is 4:00 p.m. CST. Funds will typically be available on the next business day (See Processing days). Items deposited will not be available for viewing through Online Banking until daily processing completes.

- Processing days for Mobile Check Deposit are Monday – Friday, with the exception of Federal Holidays.

- Log in to your CSB Mobile Banking App.

- Endorse the back of your check with:

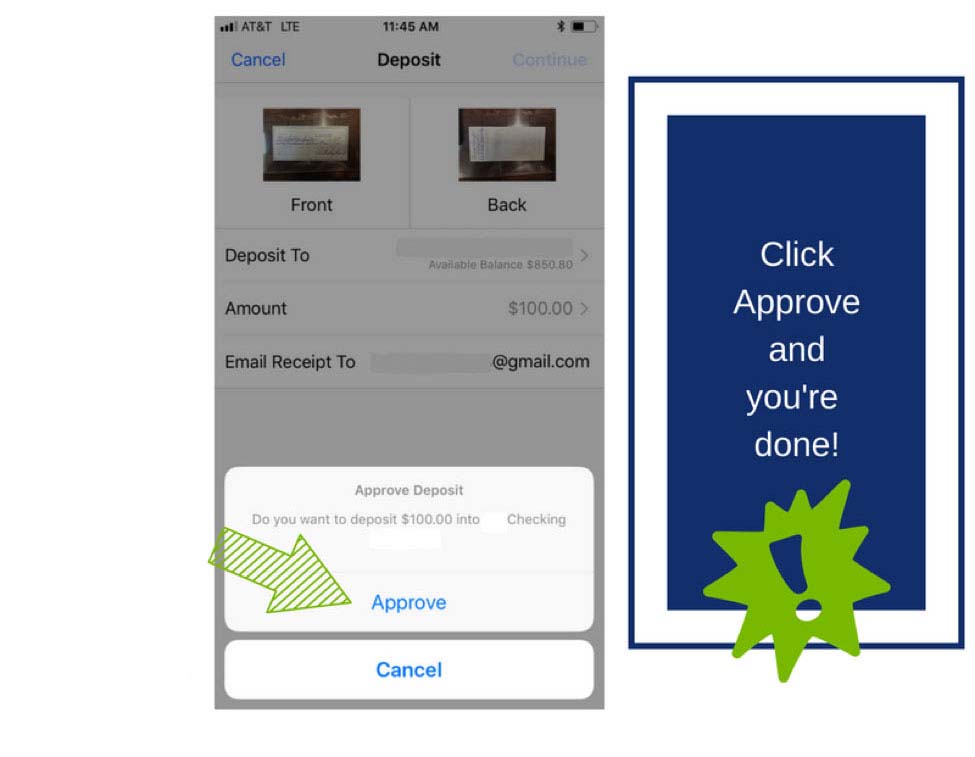

Signature, Account Number, For Mobile Deposit Only - Select Deposit on mobile app home screen.

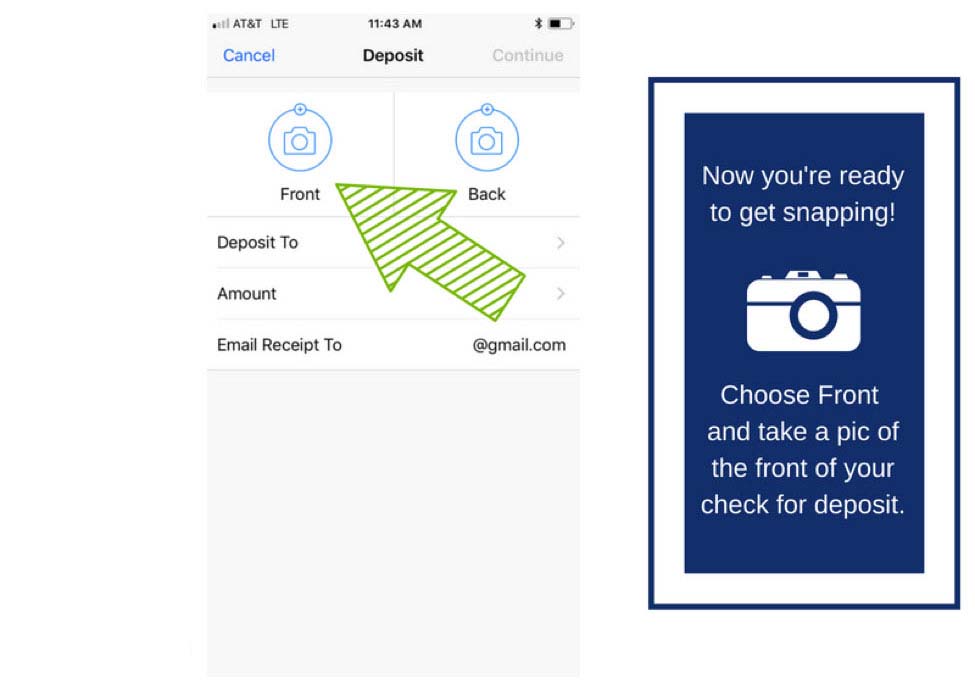

- Take a picture of the front of your check (keep following the prompts).

- Take a picture of the back of your check (keep following the prompts).

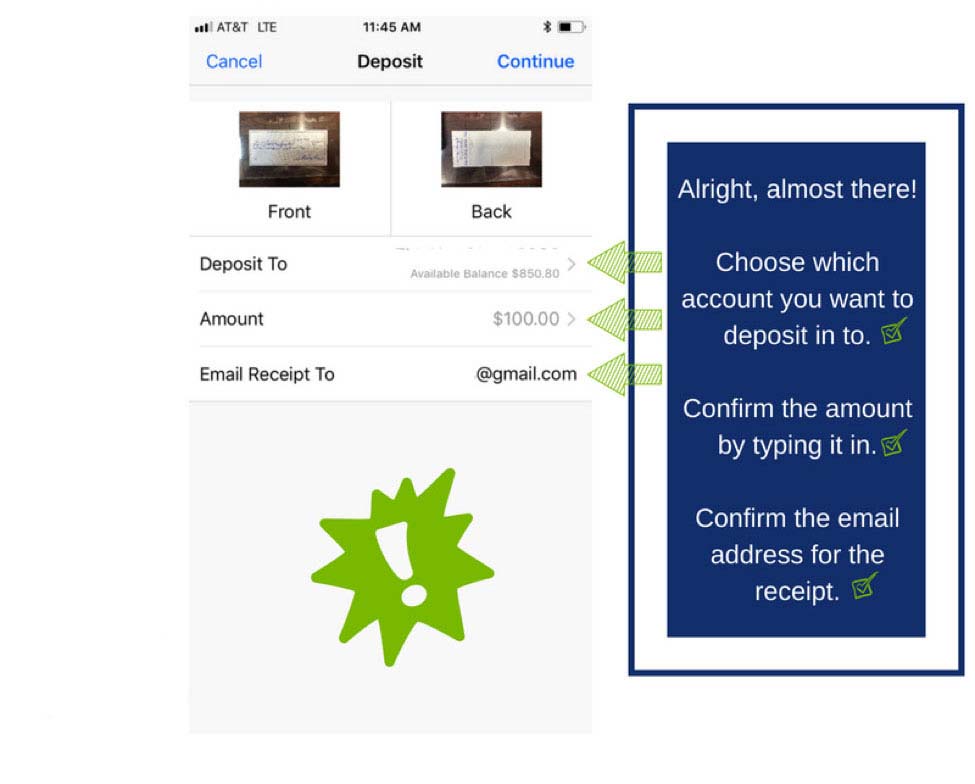

- Choose the account you want to deposit in to.

- Enter the amount EXACTLY as it appears on the front of the check.

- Confirm the email address for receipt is correct.

- Click Approve.

- Take photo against a background with strong contrast between the check and surrounding area.

- Position the camera directly above the check so there is no angle.

- Move any objects that show up in the picture away from the check.

- Make sure the check is visible, contains all four corners, is well lit and in focus.

- The check MUST contain a readable; check number, payee name and endorsement.

- The check MUST contain a readable character (numeric) amount of the check and legal (written) amount of the check.

- The check MUST be drawn on an institution located within the United States.

- Mobile Check Deposit users are required to retain the original check for 60 days after deposit has been transmitted to the bank.

- This provides sufficient time for research in case there is an issue with the image quality or if the original item is required for another reason.

- The paper check should be stored in a secure place, notating the “mobile deposit date,” so you will have access to the check in question should you need it for verification purposes.

- Mobile Check Deposit users are required to securely destroy the original paper check after 60 days.

- To securely destroy; a cross-cut shredder will assist in complete destruction of the check information.

- Do not leave deposited checks lying around, do not put deposited checks in the trash or recycle containers, unless they have been shredded first.

- All Mobile Check Deposits are subject to our right to hold funds as otherwise provided in the deposit account agreements. Availability of credit from items processed under this agreement will be subject to our funds availability schedule, which may be amended. Funds from deposit made via Mobile Check Deposit generally will be available for withdrawal on the first business day after the day of deposit.

- Mobile Check Deposit user agrees to scan and deposit only “checks” as that term is defined in Federal Reserve Regulation CC (“Reg CC”). When the image of the check transmitted to Community Spirit Bank is converted to an Image Replacement Document for subsequent presentation and collection, it shall thereafter be deemed an “item” within the meaning of Articles 3 and 4 of the Uniform Commercial Code.

USER AGREES TO NOT SCAN AND DEPOSIT ANY OF THE FOLLOWING TYPES OF CHECKS OR ITEMS WHICH SHALL BE CONSIDERED INELIGIBLE ITEMS.

- Checks payable to any person or entity other than the person or entity that owns the account that the check is being deposited into.

- Checks containing an alteration on the front of the check or item, or which you know or suspect, are fraudulent or otherwise not authorized by the owner of the account on which the check is drawn.

- Checks payable jointly, unless deposited into an account in the name of all payees.

- Checks previously converted to a substitute check, as defined by Reg. CC.

- Checks drawn on financial institution located outside the United States.

- Checks that are remotely created checks, as defined in Reg. CC.

- Checks not payable in United States currency.

- Checks dated more than 6 months prior to the date of deposit.

- Checks or items prohibited by Community Spirit Bank’s current procedures relating to the Services or which are otherwise not acceptable under the terms of your CSB account.

- Checks payable on sight or payable through Drafts, as defined in Reg. CC.

- Checks with any endorsement on the back other than that specified in user’s deposit agreement.

- Checks that have previously been submitted through the service or through a remote deposit capture service offered at any other financial institution.

- Checks or items that are drawn or otherwise issued by the U. S. Treasury Department.

Mobile Check Deposit

Mobile Check Deposit allows you to use your smart phone to take a picture of a check and deposit it into one of your accounts that are linked to your CSB Internet Banking.