P2P Fraud Reminders

One of the most exciting tools we are able to offer our customers is peer-to-peer (P2P) payments. Unfortunately, this is also a target for fraud. In the last year there has been a significant spike in P2P fraud attempts, with as many as 1 out of every 8 customers having been victimized.

We have several controls to help protect our customers, but there is a new fraud attempt circulating.

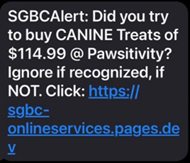

In this fraud attempt, the fraudster sends a large number of people a text message, pretending to be the bank. Some of these people are bank customers, and some are not. For those that are customers, this text appears to be legitimate, and it asks the recipient to verify a transaction.

Example of the text:

The user is prompted to click on the link because they do not recognize the transaction. The site the link goes to looks like the Digital Banking site and asks for the username and password.

Because this is a fraudulent site, if the username and password are given, the fraudster then gains access to the account information. This allows the fraudster to transfer money to themselves.

Unfortunately, these text messages can’t be stopped because they are sent directly to the customer. It is important for the everyone to be cybersmart.

Remember the following

- NEVER click on a link in a text message like this example.

- NEVER verify a transaction through a message like this. Contact the bank using a phone number from a verified source such as the website, not one delivered in a text message.

- Be suspicious of communications that require immediate attention or services will be “paused” or “discontinued”.

- Be suspicious of calls or texts creating panic by claiming your “account has been compromised”.

- If someone calls stating they are from the bank, immediately hang up and call the bank directly at a number you know.

- If something seems suspicious, listen to your gut, and call the bank directly.

- If you fall victim to a scam like this, call the bank immediately. The sooner we know, the easier it is for us to help.

- The bank will never ask you for your password. The bank will never call you and walk you through resetting your password. When in doubt, call the bank directly.